Bertram Lomfeld, Free University Berlin, Germany

What is debt? What is money? What is capital? In which way is our capitalist economic system built on debt? Does debt force unsustainable growth and deepen inequality? Could insolvency law reshape debt as a reflexive social medium? How to model democratic debt restructuring?

Debt as a primary economic medium

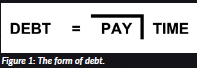

If money makes the world go ’round, debt speeds the turn. But what is debt? Debt and credit are social bonds that enable extended reciprocity over time and are a logical pair of formalised exchanges. The creditor gives something to the debtor, who owes the creditor and promises to give something back later. Essentially, debt gives a debtor time, which is normally calculated in money, to pay back what they owe. Adding regular interest rates, debt buys time.

In legal terms, both parties (creditor and debtor) enter into a binding contract. If the contractual object is money, the bond is called debt. From an analytical point of view, all time-delayed transactions are credits or debts. The central medium for exchanging, measuring and memorising debt and transactions, in general, is money. Even money is credit, promising collective and public future acceptance. Stock markets, cryptocurrencies and decentralised finance add private collective credit systems.

Debt-based reconstructions hold true for all capital circulation investing, e.g. land, material resources or funds into an economic endeavour to make a promising future profit. The primary economic medium in capitalism is debt with a basic monetary code of ‘to pay or not to pay’. Here, the term ‘liquidity’ enters the stage to classify different sorts of debt, money and capital. One subliminal objective of the project is to outline the basic constitutional legal mechanisms of collective credit systems in general.

The global debt problem

Credits serve as investments in growth for all economic actors: firms, consumers and states. Present growth is financed by debt, and refunding debt is based on future growth. Debt is a core element of the perpetual growth logic which is a central threat to sustainable development.

Debt bubbles cause financial and economic instabilities, as illustrated by the 2008 global financial crisis. The natural limits to growth on our planet (e.g. climate change) are not reflected in the economic medium. Neither is the rising distributional inequality around the globe and within nearly every national society. Both democratic governance and actors’ autonomy suffer from the structural power of heavy economic debt.

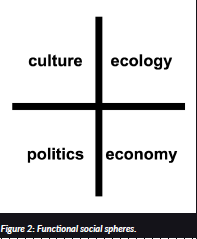

In short, an unlimited and reductionist financial conception of debt drives economic, ecological, cultural and political unsustainability. Decoupled financial markets (e.g. derivative trading), imperialistic debt politics or massive public and private debts (e.g. as a reaction to pandemic-driven recession) provide further leverage to a vicious global debt cycle.

The project’s central research question is: How can we rethink debt as a more sustainable and integrative social medium? A reflexive debt theory strives for re-embedding the economic credit system into other social spheres like politics, ecology and culture.

Governing debt by limits and re-entries

The RESOLVENCY project will rethink debt governance from its limits, i.e. debt default. Suppose the debtor only appears to become over-indebted or illiquid. In that case, all creditors try to be the first to execute their credits. A run for cash destroys any remaining potential of the debtor and weakens economic trust in general. The legal solution to this collective action problem is insolvency law which freezes credit relations and offers collective procedures for debt restructuring or asset distribution. Yet, insolvency law does much more. It ranks the creditor positions according to debt priorities (e.g. depending on collaterals) and may discharge the debtor. Such ‘insolvency factors’ ultimately decide over the value of assets as secure and alienable capital.

Most lawyers and economists conceive insolvency law as a technical tool to overcome the race of creditors for cash. The RESOLVENCY project wants to reveal the full potential of insolvency law to regulate and constitute debt markets. In this respect, the project shifts from insolvency to a ‘resolvency’ paradigm. Resolvency indicates a reintegration of over-burdened debtors (re-solvency) and resilience of social debt relations and the re-entry of other social (political, cultural, ecological) perspectives in collective credit systems.

A discoursive normative grammar (DNG) for resolvency

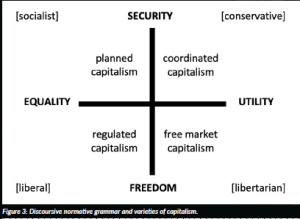

The legal core of the project is a comparative analysis of insolvency regulations for corporations, consumers and sovereign states. Quantitative analyses compare and index crucial ‘insolvency factors’ (e.g. opening criteria, priorities, discharge, restructuring decision procedures) worldwide. Followup qualitative discourse analyses of legislative motives, judicial opinions and insolvency scholarship in selected legal orders identify the normative background reasons for the specific factor design. These ‘insolvency reasons’ will be reconstructed within a ‘discourse normative grammar’ (DNG, cf. Figure 3) of fundamental legal values, which mostly coincide with different paradigms of political economies (varieties of capitalism, cf. Figure 3). The objective is to create a universal argumentative structure for debt restructuring that can incorporate diverse normative reasons from corporate, consumer and sovereign insolvency theories across different jurisdictions. The pluralist frame allows comparing and classifying national and international insolvency and restructuring regulations and integrating further social values, i.e. a wider ‘resolvency DNG’.

Democratic debt restructuring and sustainable capital

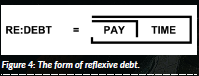

If credits do not lead to expected growth, social conflicts emerge. Really ‘resolving’ debt conflicts requires not only the consent of creditors about the distribution of remaining assets but a collective procedure including debtor and all other private (employees, inhabitants) and public (communities, environment) interests involved. The project tries to model different legal designs of such democratic debt deliberation procedures, which will be evaluated in economic game-theoretical experiments. On a substantial level, the project strives to outline some measure or index for sustainable debts combined with models on how to incentivise them by reshaping insolvency factors. Some causal assumptions of this interrelation and ex ante effects on credit markets will again be tested in experiments. The ultimate aim would be a theory of reflexive debt (RE:DEBT) which links social re-entries in collective restructuring procedures with a more sustainable coding of capital.

RESOLVENCY team and cooperation

Apart from the professorial lead, the core project team consists of three legal PhD students with multidisciplinary and multiple language capacities. Each PhD student will focus on different insolvency and restructuring areas of corporate debt, consumer debt, and sovereign state debt. The methodology and evaluation of the quantitative analyses and the experiments are co-led by an economic postdoc. Three student researchers from different disciplines and national backgrounds will support the core research team. Academic cooperation partners around the globe facilitate and validate the comparative analyses. Workshops with international debt and restructuring experts will help to evaluate project results and guarantee its methodological vigour.

Potential theoretical and practical impact

The project impacts legal and economic research on insolvency and debt theory in all social and sustainability sciences. On an academic level, the theoretical elaboration of the resolvency paradigm could stimulate new legal readings of insolvency laws as a regulatory instrument. The primary economic medium hypothesis and outcomes on ex ante effects of insolvency law are of utmost importance for economic debt theory. The interdisciplinary reconstruction of debt and collective debt systems (including money) might influence social and sustainability science models.

Regarding potential practical impact, current European unification attempts of insolvency law will surely profit from the project’s global comparative analyses and political economy classification. International financial institutions (e.g. IMF, World Bank) could be interested in substantial indexes or measurements of sustainable debt. Resolvency procedural designs and respective model collective action clauses affect political initiatives and existing institutions (e.g. ESM) on sovereign debt crisis. Democratic debt governance, including collective restructuring procedures, touch not only worldwide plans for pre-insolvency restructuring laws but also decentralised governance visions of new autonomous collective debt systems like cryptocurrencies.

To take the turn, sustainable development needs mechanisms to limit debt and its negative externalities. Reflexive debt governance might prevent the world from falling out.

Figure legends

Figure 1: The form of debt.

Figure 2: Functional social spheres.

Figure 3: Discoursive normative grammar and varieties of capitalism.

Figure 4: The form of reflexive debt.

Article summary

Project name

RESOLVENCY: A Global Theory of Reflexive Debt.

Project summary

The multidisciplinary ERC starting grant project RESOLVENCY aims to shape a new ‘reflexive’ debt paradigm by reframing insolvency law as democratic debt restructuring, including sustainable debt standards. Key methods of the project are quantitative and qualitative comparative legal analyses using the novel discoursive normative grammar (DNG) approach, accompanied by economic experiments and exploratory procedural design models.

Project lead

Prof. Dr Lomfeld studied law, philosophy and political economy at the universities Heidelberg, Cambridge, Paris-Sorbonne, Vienna and obtained his PhD at Frankfurt University. He is currently professor for private law and the foundations of law at Free University Berlin. He held visiting positions at, among others, Columbia Law School, Sciences Po Paris, LUISS Rome, and was appointed to the European Law Institute and Young Academy of Europe.

Project partners

The RESOLVENCY project is hosted at Free University Berlin. Its academic cooperation for the global comparative approach include Yale, Columbia and Harvard Law School, CUPL Beijing, Sciences Po Paris, Copenhagen and Stockholm University, European University Institute and Max- Planck-Institute for Comparative Private Law.

Contact details

Prof. Dr Bertram Lomfeld

Free University Berlin, Van’t-Hoff-Straße 8,

14195 Berlin, Germany.

Tel: +49 30 838 55915

Email: mail@resolvency.eu

Web: www.resolvency.eu

Funding

This project has received funding from the European Research Council (ERC) under the European Union’s Horizon 2020 research and innovation programme under grant agreement No. 950427.