Marco Molica Colella

CiaoTech – PNO Group

Managing Consultant R&D Advisory Services.

Email LinkedIn

Anastasiya Azarko

CiaoTech – PNO Group

Junior Innovation Consultant.

Email LinkedIn

AUTOSHIP (GA N°815012)—Autonomous Shipping Initiative for European Waters—is the largest EU-funded initiative (€29 million) focussed on realising full demonstrators of autonomous ships and their control centres for accelerating the transition to the next generation of autonomous ships within the European Union. Commencing in June 2019,

the project is scheduled for completion in November 2023.

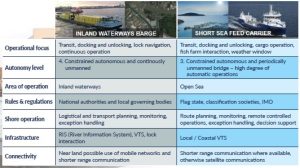

The primary objective of the project is, in fact, the development and operation (TRL 7) of two autonomous vessels, further advancing the Key Enabling Technologies package under development by Kongsberg Maritime, a global leader already on the spot for notorious commercial projects such as Yara Birkeland and the ASKO vessels. The two demos address both inland waterways and short-sea shipping markets.

On top of realising the demonstrators, approximately 20 per cent of the research effort in AUTOSHIP has been dedicated to establishing a common vision for autonomous shipping regulations, standards, operational protocols (including safety and cybersecurity), and socio-economic impacts.

When considering the motivations behind autonomy, it has become evident throughout the project that there is an initial common bias. This bias perceives autonomy as a standalone goal, primarily focussed on reducing personnel costs. Additionally, public opinion, including individuals with STEM education backgrounds, sometimes sees autonomy as contradictory to investments aimed at promoting environmentally friendly shipping. While it is crucial to analyse each project individually, as there is no one-fits-all approach, it is important to recognise that the driving forces behind autonomy intertwine the digital and green (r)evolutions within the maritime sector. These motivations go beyond mere cost reduction and actively strive to unite advancements in technology with environmentally sustainable practices.

In this context, Ciaotech – PNO Group (acting as the coordinator and exploitation manager in AUTOSHIP) took the lead in conducting a comprehensive cost benefit analysis (CBA) as part of a socio-economic impact assessment. The completed analysis delves into two distinct use case scenarios that expand on the demonstrators’ cases, offering a comprehensive overview of the key costs and benefits associated with autonomous ships. Moreover, it specifically identifies and defines the significant externalities linked to this advanced technology. The findings from this analysis shed light on the potential advantages and challenges that autonomous ships bring to shipowners, providing valuable insights for further decision-making and understanding the broader socio-economic impacts of this transformative technology.

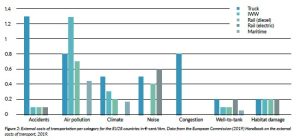

Speaking of externalities, external costs refer to the indirect expenses borne by society as a whole rather than the parties directly involved in a transaction. In other words, they are the costs that impact society at large.

It is, therefore, essential to consider the most relevant environmental and societal impacts associated with autonomous vessels, to aid informed decision-making and transport planning.

In summary, waterborne transportation is the most sustainable option in terms of external costs, while truck transportation remains the least sustainable. Despite the potential of electric trucks, their external costs in non-GHG emission categories, such as road congestion and accidents, remain significantly higher than other transportation modes. This means that even zero-emission trucks still carry a greater burden of external costs compared to alternative modes. On the other hand, waterborne transportation’s need to make progress towards achieving zero emissions can further amplify the disparity in external costs between trucks and waterborne alternatives in a future characterised by emission-free transportation.

Our analysis illustrates that autonomy is not the sole objective but works synergistically with the development of greener ships. Investments in both concepts result in an overall financial gain, creating a positive business case for the shipowners. The benefits include an increase in cargo capacity resulting from the absence/reduction of crew allocation and new ship designs. Indeed, new ship designs have the potential to unlock this synergy more effectively than retrofitting existing vessels. Collectively, autonomy can enhance the safety and resilience of the transport system and contributes to emissions reduction through better mission management and control. It can contribute to improving the working condition for seafarers and ultimately pave the way for standardised vessel designs, which can be optimised for green propulsion technologies through electrification and automation.

The particular use case scenario in the AUTOSHIP project’s CBA is based on the usage of an autonomous ship in the most relevant quadrant of the inland waterways between the ports of Antwerp and Zeebrugge. In 2021, these two ports merged to form the Port of Antwerp-Bruges, with each counterpart historically focusing on different types of cargo.

The inland waterways route (Figure 3) spans approximately 138 km and includes five lock passages and several bridges. The estimated duration for this route is 12 hours and 28 minutes. A corresponding truck route is approximately 98 km long and takes around 1 hour and 20 minutes to complete.

In brief, although the provided numbers should be considered as a mere exercise estimation, in our complete analysis, we have observed that the investment costs for autonomous vessels are comparable to standard vessels in this specific case. On the other hand, the primary operational benefit lies in increased cargo capacity and extended operational time, allowing for the accommodation of additional demand. More in detail, the CBA’s IWW study is composed of two parts. As a first step, we have compared a conventional CEMT IV ship to an autonomous design. Instead of using the demonstrator from AUTOSHIP (a retrofit of a class IV barge), we opted for a different design called the X-Barge, owned by our project partner Zulu Associates. X-Barge is purpose-built for autonomy—with no crew onboard—and is conceived to be able to operate with an electric powertrain. As a second step, we have examined the additional externalities associated with the modal shift of goods by comparing the X-Barge to equivalent truck transportation on the same route.

In step one of the study, external costs were evaluated over a 25-year period by comparing the use of a battery-electric autonomous ship to a conventional ship (Table 1).

| Inland vessel (diesel) | Inland vessel (battery) | Difference | |

| Climate change costs | € 2 14 753.44 | € 0 | – € 2 14 753.44 |

| Air pollution costs | € 1 047.70 | € 0 | – € 1 047.70 |

| Accident costs | € 48 376.98 | € 48 376.98 | € 0 |

| Noise costs | € 0 | € 0 | € 0 |

| Congestion costs | € 0 | € 0 | € 0 |

The results reveal remarkable cost savings associated with the adoption of battery-electric autonomous ships, thanks to reduced fuel consumption, which also eliminates greenhouse gas emissions and pollution (in this analysis, we assume a net-zero 2050 EU grid with zero CO2 contribution). Additionally, the absence of a crew enhances the vessel’s capacity to carry more cargo. By utilising the available space more efficiently and operating for an additional 2 300 hours, the autonomous ship can accommodate and transport an additional demand of approximately 20 275 TEUs.

| Reference scenario (conventional ship) |

Project scenario (autonomous electric ship) |

||

| Capacity (TEUs) | 80 | 90 | |

| Operational hours | 4 608 | 6 912 (+2,300h) | |

| Number of trips | 369 | 553 (+184) | |

| Number of km | 51 069 | 76 603 (+25,534) | |

| TEUs transported | 29 491 | 49 766 (+20,275) | |

| Road transportation |

Inland vessel (battery) | Difference | |

| Climate change costs | € 70 016.70 | € 0 | – € 70 016.70 |

| Air pollution costs | € 101 351.34 | € 0 | – € 101 351.34 |

| Accident costs | € 167 478.23 | € 24,188.49 | – € 143 289.74 |

| Noise costs | € 70 232.81 | € 0 | – € 70 232.81 |

| Congestion costs | € 5 402.52 | € 0 | – € 5 402.52 |

In step two, we assumed a complete modal shift, as this additional demand is transported by the battery-electric autonomous ship instead of standard (two TEU) trucks. Table 2 (lower part) illustrates the stark contrast in external costs between the two modes, with the autonomous ship outperforming trucks in every category. This resulted in significant societal benefits totalling over €390 000 per ship.

To sum up, by transitioning from a diesel-powered conventional ship to a battery-electric autonomous ship, a shipowner could gain several benefits, reduce emissions and facilitate a modal shift from road to inland waterways, intercepting additional demand. Many steps are still required, though. For future analyses, it is recommended to expand the framework of the observation and look at fleets, ports and the related infrastructure and business models. This will provide a better understanding of the impacts of autonomy in specific areas and deliver more comprehensive results.

References

European Commission, Directorate-General for Mobility and Transport (2019) Handbook on the external costs of transport – Version 2019 – 1.1. doi: 10.2832/51388.

Project summary

AUTOSHIP aims to speed up the transition towards the next generation of autonomous ships in the EU. The project will build and operate two different autonomous vessels, demonstrating their operative capabilities in short-sea shipping and inland waterways scenarios, with a focus on goods mobility.

Project partners

The AUTOSHIP consortium is composed of ten experienced partners with proven capability to cover the essential parts of the developments (KET development, testing, manufacturing, environmental/cost/social life cycle analysis, logistics). The companies involved in the initiatives are: CiaoTech (PNO Group), Kongsberg Maritime AS, Kongsberg Digital AS, Kongsberg Norcontrol AS, Sintef Ocean, University of Strathclyde, Eidsvaag AS, ZULU Associates, Bureau Veritas and De Vlaasme Waterweg NV.

Project lead profile

Ciaotech is the Italian branch of the PNO Group, Europe’s largest independent public funding and innovation consultancy company. PNO is the coordinator of AUTOSHIP and the partner responsible for the dissemination, communication and exploitation management task, where it is involved in the development of the stakeholder and market analyses, in the definition of the exploitation plans and in the facilitation of successful dissemination of the project results to relevant stakeholders in Europe.

Project coordinator

Marco Molica Colella

(CiaoTech – PNO) Managing Consultant R&D Advisory Services

+ 06 33 268 972

https://www.pnoconsultants.com/it/

https://www.autoship-project.eu/

/marco-molica-colella-a3548239

Funding

This project has received funding from the European Union’s Horizon 2020 research and innovation programme under grant agreement No. 815012.